Historical Returns Have Generally Been for Stocks of Small Firms

It doesnt tell you whether it. Mike Price MSF has ten years of experience value investing.

/ScreenShot2019-08-28at1.59.03PM-2e8cb1195471423392644ee65bf2ca31.png)

Where Can I Find Historical Stock Index Quotes

Marketplaces can benefit from scalability and network effects and dont have to spend.

. The following chart shows rolling 10-year returns from 1938 through 2019 for the performance of stocks compared to bonds. Long-Term Returns From Stocks. Historically small firm stocks have earned higher returns than large firm stocks.

Past and Prologue 36. 25 the risk - free rate is 700 and the Fund s assets are as follows Stock Investment Beta A 200000 150 B 300000 050 C 500000 125 D 1000000 075 1177 10. None of these options There is no evidence of a systematic relationship between returns on small-firm stocks and returns on large-firm stocks.

Financial risk is reduced through mutual fund investments because the fund is able to diversify investments. They have greater growth potential and tend to offer better returns over the long-term but they. One of the most popular equity indices the Standard Poors Index was created in 1926 to reflect the performance of the top 500 largest companies of the US Stock Market.

Historical returns have generally been _____ for stocks of small firms asthan for stocks of large firms. For example 1950 represents the 10-year annualized return from 1940 to 1950. Rolling 10-year returns for each year represent the annualized return for the previous 10 years.

The study assumed that each stock was bought at either the offer price or at the end of the first month of trading. The stock market has proven to produce the highest gains over long time periods. Historical returns have generally been _____ for stocks of small firms as than for stocks of large firms.

A balanced portfolio of stocks and bonds isnt far behind with only approximately a 4 lag reinforcing. Consider Consider the following information and then calculate the required rate of return for the Universal Investment Fund which holds 4 stocks The market s required rate of return is 13. View the full answer.

-3849 2008 Last Update. One hundred dollars invested in the SP 500 in 1928 would have been worth more than. Stocks have performed about 20 better than bonds averaging annual returns of 1034.

The past decade has been great for stocks. However inflations varying impact on stocks tends to increase the equity market volatility and risk premium. There is no evidence of a systematic relationship between returns on small firm stocks and returns on small firm stocks.

When viewed in the context of an efficient market this suggests that _____. If a stock goes up 15 in one year you dont know whether it is a good investment now. Though 10 is the average.

Chapter 05 - Risk and Return. If you are promised a nominal return of 12 on a one year investment and. Updated May 11 2020.

100 3 ratings Please find below the solution. Many market experts recommend holding stocks for the long term. To a proponent believer of an efficient market this suggests that.

Government subsidies available to small firms produce effects that are discernible in stock market statistics C. Historical returns have generally been _____ for stocks of small firms as than for stocks of large firms. High inflation has historically correlated with lower returns on equities.

Small-cap companies tend to be riskier investments than large-cap companies. Historically small firm stocks have earned higher returns than large firm stocks. In the last 95 years 1926 28 Feb 2022 the SP Index has generated around 10-11 annual average returns and.

Past returns can be helpful when analyzing a stock or fund. The SP 500 is often considered the benchmark measure for annual stock market returns. From 2012 through 2021 the average stock market return was 148 annually for.

When viewed in the context of an efficient market this suggests that. His study examined the IPO returns of nearly 9000 stocks that went public since 1968. The average stock market return is about 10 per year for nearly the last century.

False Question 9Investing in a mutual fund. Operating an e-commerce marketplace has generally been more profitable than direct selling online. One of the most comprehensive studies of IPO returns was conducted by Jeremy Siegel at the Wharton School at the University of Pennsylvania.

Small firms are better run than large firms B. The SP 500 experienced losses in only 11 of the 47 years from 1975 to 2022 making stock market returns quite volatile in shorter. Historically small-firm stocks have earned higher returns than large-firm stocks.

True Question 8 Net asset value of a mutual fund is calculated weekly. Let me know if you need any cl. The most vital action you take will be that you think about it with a long time horizon.

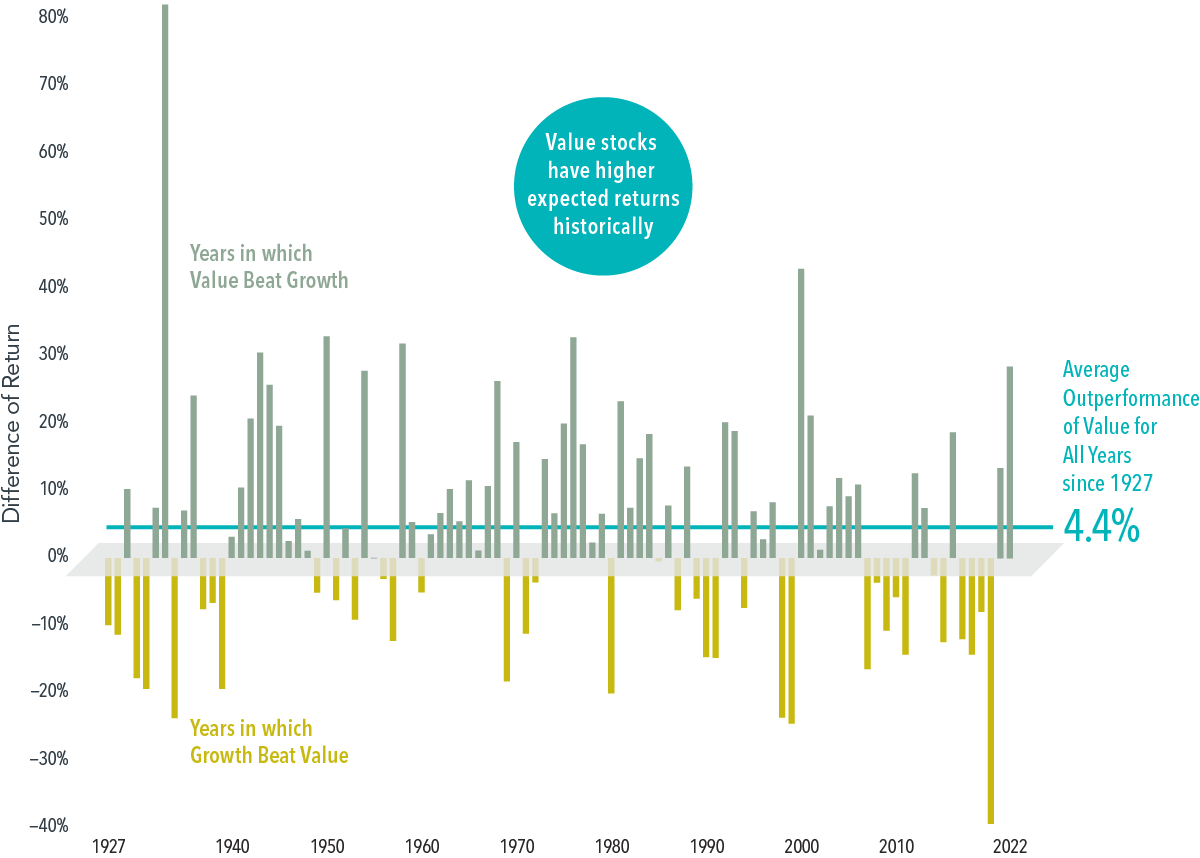

When It S Value Vs Growth History Is On Value S Side

When Is The Best Time To Invest In Small Cap Stocks The Motley Fool

When Is The Best Time To Invest In Small Cap Stocks The Motley Fool

:max_bytes(150000):strip_icc()/ScreenShot2019-08-28at1.59.03PM-2e8cb1195471423392644ee65bf2ca31.png)

Comments

Post a Comment